Everything about Pvm Accounting

Fascination About Pvm Accounting

Table of ContentsPvm Accounting for DummiesNot known Details About Pvm Accounting Examine This Report about Pvm AccountingWhat Does Pvm Accounting Do?Pvm Accounting for BeginnersPvm Accounting for Beginners

Guarantee that the accounting procedure abides with the legislation. Apply called for building bookkeeping standards and treatments to the recording and coverage of construction task.Understand and preserve typical expense codes in the bookkeeping system. Connect with numerous funding companies (i.e. Title Business, Escrow Business) relating to the pay application process and requirements needed for payment. Handle lien waiver disbursement and collection - https://www.storeboard.com/pvmaccounting. Monitor and fix financial institution concerns consisting of cost anomalies and check differences. Assist with executing and preserving interior monetary controls and treatments.

The above declarations are planned to explain the general nature and level of work being performed by individuals appointed to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills required. Personnel might be needed to do responsibilities outside of their normal responsibilities from time to time, as required.

An Unbiased View of Pvm Accounting

You will help sustain the Accel team to make certain shipment of effective on schedule, on budget plan, jobs. Accel is seeking a Building and construction Accounting professional for the Chicago Workplace. The Building Accounting professional does a range of bookkeeping, insurance policy compliance, and task administration. Functions both independently and within particular divisions to maintain monetary documents and ensure that all documents are maintained present.

Principal obligations include, but are not limited to, taking care of all accounting features of the company in a timely and accurate fashion and offering reports and routines to the firm's CPA Firm in the preparation of all monetary declarations. Makes sure that all audit procedures and functions are managed accurately. In charge of all monetary documents, pay-roll, financial and everyday procedure of the accountancy feature.

Functions with Project Supervisors to prepare and publish all monthly billings. Produces monthly Work Expense to Date reports and functioning with PMs to fix up with Project Supervisors' budget plans for each project.

The Greatest Guide To Pvm Accounting

Proficiency in Sage 300 Building And Construction and Realty (previously Sage Timberline Office) and Procore building management software application an and also. https://spotless-pea-22d.notion.site/Demystifying-Construction-Accounting-Your-Ultimate-Guide-5f9fc548c683420fabff40afc3d0c8fe. Must additionally be efficient in other computer system software application systems for the prep work of records, spreadsheets and other bookkeeping analysis that may be called for by administration. construction taxes. Must possess solid organizational skills and capacity to prioritize

They are the monetary custodians that ensure that building tasks remain on budget plan, abide by tax policies, and keep economic transparency. Building accounting professionals are not simply number crunchers; they are tactical partners in the building process. Their primary function is to take care of the economic aspects of building jobs, making certain that sources are allocated effectively and monetary threats are decreased.

Rumored Buzz on Pvm Accounting

They work closely with task supervisors to develop and check spending plans, track expenses, and forecast monetary demands. By keeping a limited hold on project finances, accounting professionals assist avoid overspending and financial setbacks. Budgeting is a cornerstone of effective building jobs, and construction accounting professionals are crucial in this respect. They produce detailed spending plans that include all project expenditures, from products and labor to licenses and insurance.

Browsing the complicated internet of tax regulations in the building and construction industry can be tough. Building accounting professionals are skilled in these regulations and make certain that the job abides by all tax obligation needs. This includes handling payroll tax obligations, sales taxes, and any type of various other tax obligation responsibilities specific to building. To master the function of a construction accounting professional, people need a strong instructional foundation in audit and finance.

Furthermore, qualifications such as Qualified Public Accountant (CPA) or Certified Building And Construction Industry Financial Specialist (CCIFP) are very related to in the industry. Building and construction jobs commonly include tight deadlines, changing guidelines, and unexpected expenses.

Everything about Pvm Accounting

Ans: Construction accounting professionals develop and check budget plans, identifying cost-saving possibilities and making sure that the job stays within spending plan. Ans: Yes, building and construction accounting professionals handle tax compliance for construction projects.

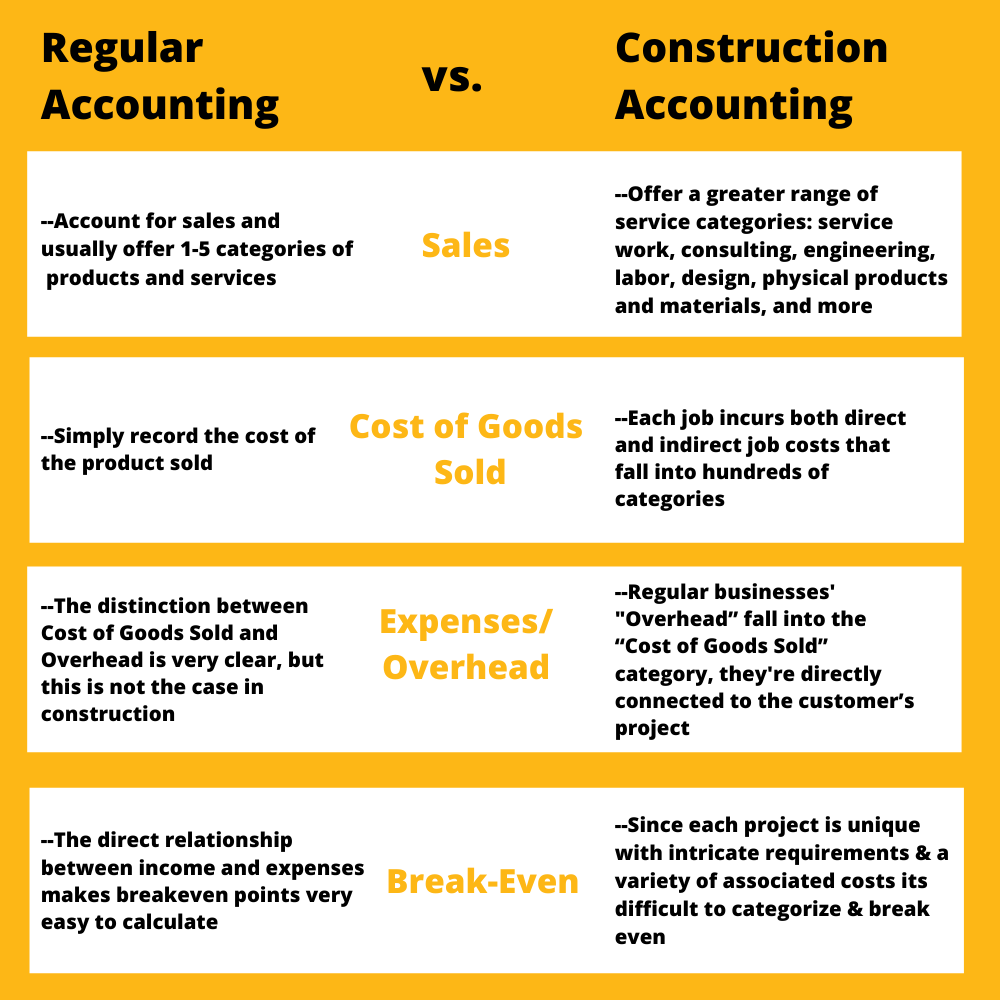

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make challenging choices among several economic choices, like bidding on one task over one more, selecting funding for products or tools, or establishing a project's profit margin. Building is an infamously unstable industry with a high failure rate, slow time to repayment, and inconsistent money circulation.

Normal manufacturerConstruction company Process-based. Manufacturing includes duplicated processes with conveniently recognizable expenses. Project-based. Production calls for different processes, products, and devices with varying expenses. Dealt with place. Manufacturing or production occurs in a single (or numerous) regulated areas. Decentralized. Each project occurs in a new area with varying site conditions and one-of-a-kind difficulties.

The 2-Minute Rule for Pvm Accounting

Frequent usage of various specialty specialists and providers influences performance and cash circulation. Settlement shows up in complete or with regular payments for the full contract quantity. Some part of settlement may be held back till project conclusion also when the service provider's work is ended up.

Regular production and short-term contracts bring about convenient capital cycles. Irregular. Retainage, sluggish repayments, and high in advance costs cause long, uneven capital cycles - construction taxes. While standard manufacturers have the advantage of controlled atmospheres and optimized manufacturing procedures, construction business should frequently adapt to each new project. Even rather repeatable jobs need that site adjustments because of website conditions and other factors.