The Buzz on Transaction Advisory Services

The 30-Second Trick For Transaction Advisory Services

Table of ContentsThe Basic Principles Of Transaction Advisory Services An Unbiased View of Transaction Advisory ServicesThe Definitive Guide to Transaction Advisory ServicesTransaction Advisory Services for DummiesGetting The Transaction Advisory Services To Work

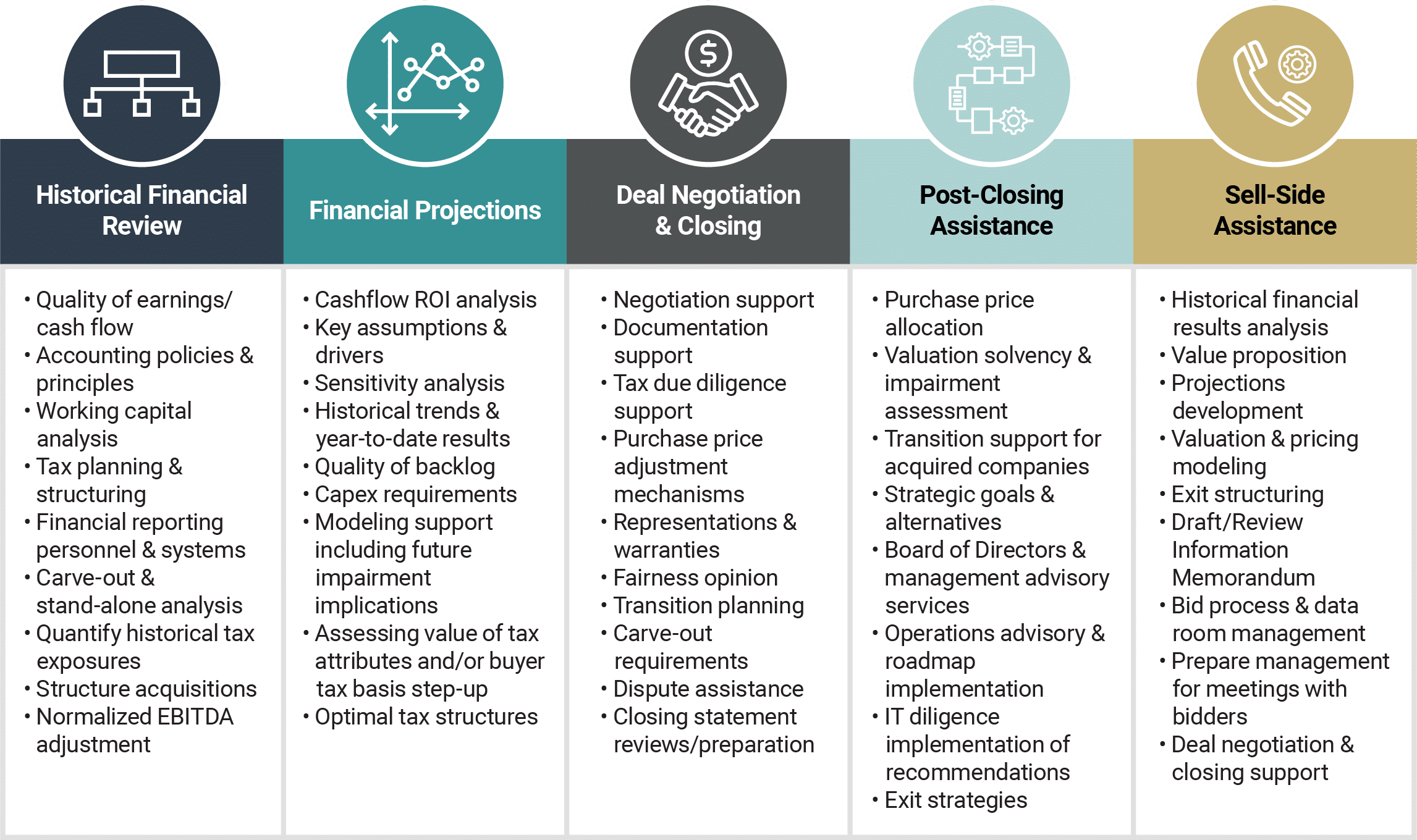

This action ensures the business looks its ideal to possible purchasers. Obtaining business's value right is critical for an effective sale. Advisors make use of various approaches, like reduced capital (DCF) analysis, comparing with similar companies, and recent transactions, to identify the fair market price. This aids establish a fair cost and bargain efficiently with future purchasers.Transaction consultants step in to assist by obtaining all the needed details arranged, answering questions from customers, and setting up sees to the company's area. This develops count on with buyers and maintains the sale relocating along. Getting the most effective terms is vital. Transaction advisors utilize their experience to assist business owners deal with tough settlements, fulfill customer expectations, and framework deals that match the owner's objectives.

Fulfilling legal guidelines is important in any kind of business sale. They help service proprietors in preparing for their next actions, whether it's retirement, beginning a new endeavor, or handling their newfound wide range.

Purchase advisors bring a riches of experience and understanding, guaranteeing that every facet of the sale is dealt with expertly. With calculated preparation, valuation, and settlement, TAS helps entrepreneur attain the highest feasible price. By making sure legal and regulative compliance and managing due diligence alongside various other bargain staff member, transaction advisors reduce prospective threats and responsibilities.

The Definitive Guide for Transaction Advisory Services

By comparison, Big 4 TS teams: Deal with (e.g., when a prospective purchaser is performing due diligence, or when a bargain is closing and the purchaser requires to incorporate the company and re-value the vendor's Balance Sheet). Are with costs that are not linked to the offer shutting effectively. Gain charges per involvement somewhere in the, which is much less than what investment financial institutions earn also on "small offers" (but the collection chance is likewise much greater).

, yet they'll concentrate much more on bookkeeping and appraisal and much less on subjects like LBO modeling., and "accounting professional only" topics like trial equilibriums and just how to stroll through occasions making use of debits and credit reports rather than economic statement changes.

Things about Transaction Advisory Services

that demonstrate how both metrics have actually changed based upon items, channels, and customers. to judge the precision of monitoring's previous forecasts., including aging, inventory by product, ordinary degrees, and arrangements. to establish whether they're entirely imaginary or somewhat believable. Professionals in the TS/ FDD groups may additionally interview management regarding every little thing over, and they'll write an in-depth record with their searchings for at the end of the process.

, and the basic form looks like this: The entry-level role, where you do a lot of information and economic analysis (2 years for a promotion from below). The following degree up; similar work, but you get the more interesting little bits (3 years for a promo).

Specifically, it's challenging to obtain advertised past the Manager degree because few people leave the job at that phase, and you require to begin revealing proof of your capacity to create earnings to advancement. Let's begin with the hours and way of living given that those are less complicated to explain:. There are occasional late nights and weekend break job, yet absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living modifications, so expect lower settlement if you remain in a cheaper place outside significant monetary centers. For all positions other than Companion, the base salary comprises the mass of the complete compensation; the year-end bonus offer may be a max of 30% of your base pay. Frequently, the very best method to boost your earnings is to change to a different firm and negotiate for a greater wage and incentive

Some Ideas on Transaction Advisory Services You Need To Know

You can enter business advancement, however investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Expert roles. Company financing is still an option. At this phase, you must just stay and make a run for a Partner-level role. If you wish to leave, perhaps transfer to a client and perform their appraisals and due diligence in-house.

The primary issue is that due to the fact that: You typically require to join another Large 4 group, such as audit, and work there for a few years and afterwards move right into TS, job there for a few years and after that move into IB. And there's still no guarantee of winning this IB function due to the fact that it depends on your region, customers, and the hiring market at the time.

Longer-term, there is likewise some risk of and because assessing a business's historic monetary info is not exactly brain surgery. Yes, human beings will certainly constantly need to be included, yet with more innovative technology, reduced useful reference head counts could possibly sustain customer involvements. That said, the Transaction Services team defeats audit in regards to pay, job, and leave possibilities.

If you liked this short article, you could be curious about reading.

Little Known Questions About Transaction Advisory Services.

Develop innovative economic frameworks that aid in identifying the real market price of a company. Supply advising operate in connection to organization evaluation to help in negotiating and rates frameworks. Describe one of the most appropriate kind of the bargain and the type of consideration to employ (cash, supply, make out, and others).

Establish activity prepare for risk and exposure that have been recognized. Perform combination preparation to identify the procedure, system, and organizational adjustments that might be required after the bargain. Make numerical price quotes of combination costs and advantages to analyze the financial rationale of integration. Establish guidelines for incorporating divisions, technologies, and company processes.

Recognize potential reductions by decreasing DPO, DIO, and DSO. Examine the possible consumer base, industry verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and article up-selling (Transaction Advisory Read Full Report Services). The functional due diligence supplies crucial insights into the functioning of the company to be gotten concerning danger assessment and worth production. Determine short-term adjustments to funds, banks, and systems.